Texas Legislature on Track to Approve $48 Billion in New Spending

New Spending Reduces Potential Tax Cuts Now and in the Future

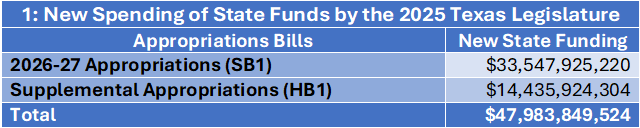

When the Texas Senate meets this week to adopt the 2026-27 budget for the state of Texas, it is likely to put Texas on track to approve almost $48 billion in new spending of state funds. Out of the $48 billion in new spending, only $6 billion is set aside for property tax relief.

Figure 1 breaks down the new spending. Senate Bill 1 is the Legislature’s appropriations bill for the upcoming 2026-27 fiscal biennium. It contains $33.5 billion in new spending. House Bill 500 is the Legislature’s supplemental appropriations bill for spending during the current 2024-25 fiscal year. It may lead to $14.4 billion in new spending.

New spending does not always correlate precisely with increased biennial spending. The importance of determining new spending in the budget is that it allows us to calculate how much tax relief Texan taxpayers could get if the Legislature prioritized reducing our taxes over new spending that benefits other legislative constituents, who often use our tax dollars to hire lobbyists so they can get a bigger cut of the pie next time around.

Texas Can Assist in Reducing the Number of Illegal Aliens in the United States

Introduction

With President Donald Trump in office, the issues surrounding illegal immigration are rapidly changing. To date, he has declared a national emergency at the Southern Border, suspended the entry of illegal aliens into the United States across the Southern Border, and ended taxpayer subsidization of open borders. He is also deporting criminal illegal aliens after invoking the 1798 Alien Enemies Act, an action that has caused Democrats to lose what little credibility they have left as they fight to keep these criminals in the country.

To this point, his efforts seem to be working. According to ABC News, “In the 11 days after Jan. 20, migrants apprehended at ports of entry declined by 93%.” The Federalist reports that illegal migrant apprehensions dropped from “an average of 2,000 per day in the weeks before Trump’s inauguration to just 786 following the inauguration.”

The Trump measures have made illegal crossings into the U.S. much less attractive. Yet there are still “magnets” that might cause potential immigrants to illegally cross the border into Texas. Perhaps even more important given the recent changes in U.S. policy these magnets might also induce illegal aliens to stay in Texas.

One group has estimated the 2022 cost of illegal immigration to Texans at $9.9 billion. These costs make it clear that as important as it is to stop illegal immigration, it is also important to reduce the number of illegal aliens residing in Texas. Reducing the immigration magnets can help us accomplish both of these goals.

Read MoreThe Problems with the Texas House of Representatives' School Choice Bill

The Book of Daniel tells us that “Nebuchadnezzar king of Babylon came to Jerusalem and besieged it.” As we know, he was successful and completely destroyed Jerusalem and its temple, visiting God’s wrath on His people for failing to worship Him. After his victory, Nebuchadnezzar recognized the talent of some of the Israelites who survived and “he commanded Ashpenaz, his chief eunuch, … to teach them the literature and language of the Chaldeans” so that they might become officials in his kingdom.

This highlights the fact that public education has been around for a long time—at least 2,500 years. Its purpose, then and now, has been to create a class of citizens who are able and willing to support the goals and work of the state.

Donald Trump has been elected president twice because voters came to realize that the goals and work of the state are not always aligned with the interests of the average citizen. As we examine three aspects of the current school proposal in the Texas House of Representatives—House Bill 3, we will keep in mind whose interests are being served.

Cost

The school choice program under House Bill 3 will receive about $1 billion to fund the program for the 2026-27 school year. This is in addition to another $12 billion in increased public-school funding the House has proposed in its budget; $7.5 billion of which is accounted for in House Bill 2, the government school funding bill. While these are separate bills and separate programs, make no mistake the two are tied together. The Legislature, both House and Senate, are using school choice as a cover for a massive increase in funding for government schools. Or, perhaps, they are using the $7.5 billion as a bribe to get the public education establishment to not protest—too much—about school choice. Whichever way this game of thrones plays out, it is taxpayers that will be on the hook for the $13 billion price tag.

Regulations

Another problem with HB 3 is the requirement that the education expenses using an Education Savings Account (ESA) must be “approved;” in fact, they must be “preapproved.” Families using an ESA are not allowed to spend the money on just any “educated-related service” or product. Rather, parents will be allowed to spend their ESA funds only on products and services that come from “preapproved providers and vendors.”

For families interested in using an ESA for a pre-approved private school, the school must be accredited. For homeschool families, tutors and teaching services must also be accredited or have a license. Additionally, purchases of curriculum, books, online courses, etc. must be made from vendors who have been pre-approved by the Texas Comptroller. HB 3 provides little guidance to the comptroller on this. It is likely homeschooling families will face significant challenges in the ESA program using the same products and instructional services they currently use.

Tax Dollars Instead of Tax Credits

The underlying problem with HB 3 (and the Senate’s SB 2) is that it funds school choice with tax dollars instead of tax credits. One problem with this is that by using taxpayer funds it makes it much easier to extend government regulation on private and home schooling. Along these lines, using tax dollars also increases the calls for “accountability” of the use of the ESAs. Accountability has its place, but I wish we’d hear a lot more calls for accountability when it comes to spending by government schools. Finally, using tax dollars in a separate account reduces the competition for funding that government schools must face and the need for them to improve. One of the key selling points for school choice is that it will improve government schools; that is unlikely to happen if HB 2 and HB 3 become law.

The Path Forward

The path to an ESA school choice program that many current homeschool and private school families might support is straight forward; fund it with tax credits. Any parents with child age children would be eligible for a property tax credit, whether they are homeowners or renters. If they use an ESA, they might also be exempt from sales taxes. Additionally, businesses might receive property tax or franchise tax credits if they contribute to students’ ESA accounts; they might set up funding for students at particular schools or those who are studying particular subjects.

Since in a tax credit system the money never belongs to the government, this approach creates more competition for government schools that would have to respond to children leaving and taking their tax dollars with them. It also removes the problem of regulations coming with government funding and would also leave it to the parents to decide how to best use their accounts to educate their children. Finally, the efficiencies forced on the system would likely reduce the cost of public education in Texas.

All said, HB 3 and its companion HB 2 are more aligned with the interests of the state and those who benefit from receiving taxpayer funds that with the Texans who pay the taxes and the many who pay twice for education—once for government schools and again for their own children. I’ve been working to get school choice in Texas since 1997. And while I do not want to delay much longer, it would be worth it to wait until 2027 if that is what it takes to get it right.

Read MoreProposed Property Tax Relief Falls Short in the 89th Texas Legislature

Texans Will Get Less Than $4 Billion Out of the $24 Billion Budget Surplus

Though it is difficult to discern from recent statements of Texas’ legislative leaders, the Texas Senate has budgeted only $3 billion for new property tax relief this session and the Texas House has provided $3.5 billion (Figure 1). This is the case even though Texas has a current budget surplus of $24 billion and will have many more billions in new revenue coming online during the upcoming 2026-27 fiscal biennium.

Why is this happening? The bottom line is a string of poor decisions by the Texas Legislature that allow local governments and school districts to greatly increase spending and property taxes (Figure 2) every year. These decisions greatly increase the costs of maintaining previous, largely ineffective, legislative efforts to provide property tax relief.

Seeking Silver and Gold: TxLege Update Week 2

Politicians in America may be elected by the people, but their authority to rule comes from God: “there is no authority except from God.” Pagans or believers, politicians are “the servant[s] of God” whose duty is to be “God’s servant for [those who do] good” and “an avenger who carries out God’s wrath on the wrongdoer” (Romans 13).

Yet, as we all know, we live in a fallen world (Genesis 3) and politicians are going to fail in their duties to God, just like the rest of us. The Bible tells us that one of the main ways politicians fail is that they are going to take our stuff. God warns politicians that they “must not acquire many horses for himself or cause the people to return to Egypt in order to acquire many horses, since the Lord has said to you, ‘You shall never return that way again.’ And he shall not acquire many wives for himself, lest his heart turn away, nor shall he acquire for himself excessive silver and gold. (Deuteronomy 17:16-17).

Nonetheless, like Solomon, many of our rulers ignore God and instead “take []our sons and appoint them to his chariots and to be his horsemen … and some to plow his ground and to reap his harvest … [and] He will take your daughters to be perfumers and cooks and bakers. He will take the best of your fields and vineyards and olive orchards and give them to his servants. He will take the tenth of your grain and of your vineyards and give it to his officers and to his servants” (1 Samuel 8:10-15). The list of acquisitions goes on.

Read MoreTexas Model Legislation: The Law of God

Acknowledging the Laws of God in the Texas Constitution

Now that members of the Texas Legislature can file legislation, I am sending out model legislation for them to consider. The drafts will offer possible solutions for improving our liberty and reducing the size, scope, and burden of Texas government. Some will propose amendments to the Texas Constitution, others changes to Texas statutes. While focused on the state of Texas, most of these concepts could be applied in other states, though the legislation would have to be redrafted according to the laws and drafting standards of each state.

Draft (Word); Draft (pdf); Explanation (Word); Explanation (pdf)

Purpose of proposed legislation

To confirm that the rights of Texans acknowledged in the Texas Constitution’s Bill of Rights flow from and are subject to not only human laws but to the laws of God.

Explain the problem being addressed

With the increasing rejection of the U.S. Constitution by the government of the United States and many politicians in Texas’ state and local governments, Texans should affirm that there is a higher authority over the rights of Texans and the laws that govern them.

Explain how the proposed legislation addresses the problem

The amendment places into Texas constitutional law the fundamental concept that the rights of Texans and the laws that govern them are subject to the laws of God.

What statute(s) would be changed by proposed legislation?

Article 1, Section 1 of the Texas Constitution.

Explanation of Proposed Legislation

The first words of the Texas Constitution, contained in its preamble, are “Humbly invoking the blessings of Almighty God, the people of the State of Texas, do ordain and establish this Constitution.”

The words of the Texas Constitution are much like other founding documents of our nation. For instance, the U.S. Declaration of Independence acknowledged God as the source of our laws and our liberty: “We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.”

The Declaration also acknowledges the sovereign authority of God’s laws: “When in the Course of human events, it becomes necessary for one people to dissolve the political bands which have connected them with another, and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature's God entitle them …”

Additionally, the Mayflower Compact, probably the first American governing document written by the colonialists themselves, begins: “IN THE NAME OF GOD, AMEN. We … in the Presence of God and one another, covenant and combine ourselves together into a civil Body Politick for our better Ordering and Preservation, and … for the Glory of God, and Advancement of the Christian Faith, and the Honour of our King and Country.”

And the charters of the various American colonies, such as for the Virgina colony, acknowledge God and His providence.

This amendment would likewise acknowledge the sovereignty of God over Texas, its laws, and its people. It would do this by adding the following underlined language:

Texas is a free and independent State, subject only to the laws of God and the Constitution of the United States, and the maintenance of our free institutions and the perpetuity of the Union depend upon the preservation of the right of local self-government, unimpaired to all the States.

In doing this, the rights of Texans would be better secured and the rule of law enhanced though the acknowledgment in Texas law that our rights and laws are subject not only to the U.S. Constitution but to God.

Previous Texas Model Legislation

- Placing the Preamble of the U.S. Declaration of Independence into the Texas Constitution’s Bill of Rights

- Allowing Consideration of Legislation that Repeals Current Law in the First 60 Days

Texas Model Legislation: God-given Rights

Placing the Preamble of the U.S. Declaration of Independence into the Texas Constitution’s Bill of Rights

Now that members of the Texas Legislature can file legislation, I’ll be sending out model legislation for them to consider. The drafts will offer possible solutions for improving our liberty and reducing the size, scope, and burden of Texas government. Some will propose amendments to the Texas Constitution, others changes to Texas statutes. Some of the concepts offered may only be of use in Texas, while others might be applied in other states, though the legislation would have to be redrafted according to the laws and drafting standards of each state.

Draft (Word); Draft (.pdf); Explanation (Word); Explanation (.pdf)

Purpose of proposed legislation

- To acknowledge that Texans are endowed by God with certain unalienable rights by putting the preamble of the U.S. Declaration of Independence into the Texas Constitution’s Bill of Rights.

Explain the problem being addressed

- ·Too often today rights in American and Texas are treated as grants from the government—and what government grants it may also take away.

Explain how the proposed legislation addresses the problem

- The amendment places into Texas constitutional law the fundamental concept that founded our nation: the rights of Texans are granted to them by God, the Creator of all people, heaven, and earth, and thus are not subject to the caprice of Texas government officials or the tyranny of the majority.

What statute(s) would be changed by proposed legislation?

- Article 1; Section 2 of the Texas Constitution.

Explanation of Proposed Legislation

Throughout the United States today, the rights of Americans are being treated as temporary grants of the beneficence of the state that are granted today but can be taken away tomorrow. Texas is in better shape than most states, yet there are still problems here.

For instance, the Texas Supreme Court has ruled that “Property owners do not acquire a constitutionally protected vested right in property uses.” (City of University Park v. Benners, 485 SW 2d 773 (1972)). In other words, Texans have title to the dirt or water or other minerals that make up the land they own, but do not have the right to use them without permission from the state. The parental rights of Texans are also under attack. Such as in the case of Jackie and Juan Boatright, who had their daughter Evelyn wrongfully and illegally taken from them.

Law professor Jeffrey Tuomala has written, “Declarations of rights alone don’t secure life, liberty, or property. The institutions, procedures, and allocation of powers that comprise a framework of government are themselves designed to secure fundamental rights. They do so in two ways. The first is to provide an effective government that can ensure peace and protect citizens from the depredations of others. The second is to establish certain limitations on that government to protect citizens from overbearing officials and institutions.” Yet as we have seen in Texas and across the United States, even the best designed framework of government will not protect the rights of Americans from overbearing officials and institutions when it fails to acknowledge that our rights are God-given and thus unalienable.

The preamble of the Texas Constitution already acknowledges “the blessings of Almighty God.” This amendment would simply acknowledge that the blessings of God extend to the unalienable rights with which Texans have been endowed by Him.

Read MoreTexas Model Legislation: First 60 Days

Allowing Consideration of Legislation that Repeals Current Law in the First 60 Days

Now that members of the Texas Legislature can start filing legislation, I’ll be sending out model legislation for them to consider. The drafts will offer possible solutions for improving our liberty and reducing the size, scope, and burden of Texas government. Some will propose amendments to the Texas Constitution, others changes to Texas statutes. I’ll also provide a brief description of the proposed legislation, its purpose, and the problem it is designed to address. Some of the concepts offered may only be of use in Texas, while others might be applied in other states, though the legislation would have to be redrafted according to the laws and drafting standards of each state.

Model Legislation #1: Allowing Legislation that Repeals Current Law to Be Considered in the First 60 Days of a Legislative Session

Draft (Word); https://www.excellentthought.net/wp-content/uploads/Repealer-Constitutional-Amendment.pdf; Explanation (Word); Explanation (pdf)

Purpose of proposed legislation

· Allows legislation that only repeals existing law to be considered in the first 60 days of the Texas Legislature’s biennial regular session.

Explain the problem being addressed

· Bills that reduce the size and scope of government by repealing existing law, in the spirit of the framers of the Texas Constitution who sought a government that focuses on securing and protecting the life, liberty, and property of citizens, have a hard time competing with other legislation once the first 60 days is past.

Explain how the proposed legislation addresses the problem

· Provides a spotlight and opportunity for bills that only repeal existing statute by amending the Texas Constitution so the Legislature can consider and vote on these bills during the first 60 days of a regular session.

What statute(s) or portion of the Texas Constitution would be changed by the proposed legislation?

· Article 3; Section 5 of the Texas Constitution.

Explanation of Proposed Legislation

The drafters of the Texas Constitution sought to model the founders of the United States in designing a government focused on securing and protecting the life, liberty, and property of citizens. One provision to this end, outlined in Article 3; Section 5 of the Texas Constitution, restricts the Legislature’s ability to consider bills during first 60 days of the session—only emergency legislation designated by the governor can be considered and voted on by each house during this time. This restriction slows the legislative process, allows for more deliberation of the issues, and provides for more transparency and involvement by citizens. Because most legislation today is designed not to protect liberty but to undermine it, the additional time and scrutiny allowed by delayed consideration of bills helps slow the growth of the administrative state.

Lost amidst the clutter of the more than 6,000 bills filed each session are bills that seek to reverse the growth of government and keep it within the confines of the founder’s vision. In particular, bills that eliminate government programs and repeal laws rarely are considered during a legislative session, and even less often actually become law. This proposed amendment to the Texas Constitution provides a spotlight and opportunity for bills that repeal existing statute by allowing the Legislature to consider and pass these bills during the first 60 days of a regular session.

One bill from the 85th Texas Legislature (2017) that might have benefitted from this provision was HB 340 that would have abolished shampoo apprentice permits. That is right; it was once illegal to shampoo a person’s hair in Texas unless one holds a shampoo apprentice permit or student permit. Yet this commonsense legislation could not compete on a legislative calendar crowded with bills that would grow government (though it later did).

With the passage of this amendment, the Legislature would be able take up and pass bills in the first 60 days that only repeal existing statutes, changing the dynamic of the debate in the Texas Legislature. It would make debate over reducing the size and scope of government one of the central focuses for half of the session. This could help overcome the lack a specific, concentrated constituency that generally can be counted on to support legislation designed to take government in the opposite direction.

Read MoreTexas Politicians and the Ninth Commandment

Three weeks ago, I wrote that most Texas politicians have been falsely claiming they provided $18 billion in tax relief, not the $12.7 billion they actually provided.

Today, I’ll be back in the Texas capitol testifying before the Texas House Select Study Committee on Sustainable Property Tax Relief with evidence to back up that statement and my claim that what the Legislature is doing on property taxes is not working. I’ll get to that in a minute, but first I want to lay a foundation to help us understand why Texas politicians can’t, or won’t, stop making false claims about their work.

Exodus 20:16 gives us the Ninth Commandment: “You shall not bear false witness against your neighbor." Christianity has long held this to require more than just not lying about our neighbor.

Question 144 in the Westminster Larger Catechism says that it requires “from the heart sincerely, freely, clearly, and fully, speaking the truth, and only the truth.” It supports this exposition with Ephesians 4:25: “Therefore, having put away falsehood, let each one of you speak the truth with his neighbor …” On the negative side, WLC Question 145 says the Ninth commandments tells us we must not “prejudice the truth,” meaning we must not obscure the truth.

With this in place, let’s get back to the details.

In response to rapidly rising property taxes, Texans starting clamoring for property tax relief back in the late 1990s. Since then, property taxes have increased from $18.9 billion (1998) to $82.6 billion. Unless you define property tax relief as meaning property taxes are a little lower than they would have otherwise been, Texas taxpayers have received no relief at all. The chart at the top of this article affirms this by showing the growth of property taxes over the last five years.

This provides the backdrop for why many state leaders and members of the Texas Legislature might want to obscure the truth about property taxes: after almost thirty years of requests from Texas voters, Texas politicians have provided no property tax relief. If Texas voters truly understood this—like they did about school choice and the Ken Paxton impeachment this year, it might be harmful to the reelection efforts of a number of incumbents.

In the testimony I’ll present to the committee today, I quote the first four statements below; I’ll add a couple of more to make sure the Texas Senate is well represented and another one that was just posted on X last night:

"Today, I am signing a law that will ensure more than $18 billion in property tax cuts—the largest property tax cut in Texas history." – Gov. Greg Abbott.

“The Senate unanimously passed … the largest property tax cut in Texas history, and likely the world.” – Lt. Gov. Dan Patrick

“Providing Texans with the largest state property tax cut in American history.” – Speaker Dade Phelan

“The House has passed … the largest property tax cut in TX history!” – Rep. Morgan Meyer

“We can be proud that … we are … voting on an astounding $18 billion property tax cut, which is the largest in the state’s history …” - Sen. Paul Bettencourt

“The $5.3 billion that is in here for compression … is in addition to previous compression so it actually lowers M&O rates by 10 cents … it is new compression, is that right?” - Sen. Joan Huffman, in a conversation with Sen. Bettencourt, who affirmed her analysis, during a Senate Finance hearing

"In 2023, the Texas Legislature passed $18 billion in property tax relief, the largest cut in Texas history." - Rep. Dustin Burrows

There are two claims made in these statements that obscure the truth because they do not clearly and fully present the truth. The first claim is there was an $18 billion property tax cut. Here is Texas economist Vance Ginn explaining why this is not the case:

$5.3 billion of this $18 billion was in Section 18.79 of the General Appropriations Act (HB 1), passed in the regular session to maintain past property tax relief efforts. This resulted in just $12.7 billion in new property tax relief

To further explain this, what the members of the Legislature did was count funding already in the budget that covered previous tax relief as “new” tax relief. You can see this is what Huffman and Bettencourt are trying to convince the public of in their conversation.

Why did Texas politicians do this? Perhaps one reason is that before the 2023 Legislative session, Gov. Abbott promised Texans he would dedicate half of the state’s $32.7 billion budget surplus to property tax relief. But with legislative leaders only willing to spend $12.7 billion on property tax relief because they had other plans for the rest of the surplus, Abbott would not be keeping his promise his promise if he signed on to that. So, Abbott, Patrick, Phelan, and other legislative leaders came up with a plan: they’d go back and find $5.3 billion property tax relief from 2019 and 2021 and tell voters it was “new.”

In case you are wondering, this is not technical dispute or question of he said, she said. In 2023, the Texas Legislature only dedicated $12.7 billion of spending to provide new property tax relief. The $5.3 billion was paying for previous relief already baked into the system. To make this point clear, the Legislature also provided money for property tax relief in 2015, 2006, and 1997. Why didn’t they go ahead and claim the more than $15 billion from those previous efforts over the last 25 years as “new” relief? Because everyone would have laughed at them. The same thing might have happened with the $5.3 billion if the media had been doing its job, but most of the media were no more interested in Texans getting tax relief than were the politicians.

The next claim made by politicians is that the property tax cut was largest in the state’s history. This is easy to refute because there was no general tax cut. Using the latest data from the Texas Comptroller’s office, I estimate property taxes increased this year by $681 million. Thus, the Legislature’s $12.7 billion effort did not result in lower overall taxes.

To be clear, many if not most homeowners received property tax cuts this year because of the increase in the homestead exemption. But many businesses and apartment dwellers did not. And many, if not most, will see whatever relief they experienced this year swallowed up by a tax increase next year.

When the members claimed they had passed the largest property tax cut in history—Texas, the U.S., the world, or wherever else they might point to, what they meant was the $18 billion was more than the $16 billion the Texas Legislature dedicated to property tax relief in 2006. This provides another reason why many politicians obscured the truth about the $18 billion: while $18 billion is bigger than $16 billion, $12.7 billion is not.

But why did not even the $12.7 billion cut property tax revenue across the board? First, because the $12.7 billion has to pay for property tax relief over two years, so the amount dedicated to reducing property taxes was only $6.35 billion—the other $6.35 billion simply maintains the reduction in the second year. This is a fact legislators routinely fail to inform their constituents of. Second, because the Texas Legislature has refused to do anything about property tax increases by school districts and local governments. Every time the Texas Legislature does something about reducing property taxes, schools and local governments raise taxes and swallow up most savings that should have gone to taxpayers. The members of the Legislature know about this but are unwilling to do anything meaningful about it. The table below shows how much the different local taxing entities increased property tax revenue this year.

Property taxes are not the only way in which Texas politicians attempt to obscure the truth and hide what they are doing from Texas voters. The Texas budget is another area. I won’t go into the details here, but you can rest assured both the size of Texas government and the growth of Texas government are much larger than the Legislature leads us to believe. Here and here are the details.

Wrapping up, the table above shows what priority the politicians placed on tax relief. Not only did tax relief get less than half of the budget surplus funds, it only made up 19% of all new spending approved by the Texas Legislature in 2023. Clearly, while avoiding electoral harm from an electorate upset about property taxes was a political priority of Texas politicians, providing real, lasting property tax relief to taxpayers was not a policy priority. Instead, legislators prioritized satisfying Austin-based special interests who were clamoring for increased spending on their pet projects.

Yet this truth is not what most Texas politicians speak to the voters. Instead, they attempt to obscure the truth with phrases like “the largest property tax cut in Texas history, and likely the world.” And the media helps them cover up the facts by refusing to dig into the details, much like they did with Russia-gate and are doing with the Trump assassination attempts. Our political leaders should look to the Ninth Commandment as a guide for helping them repent of obscuring the truth and of partnering with the media in doing so.

Read MorePoliticians Can't Stop Spending Our Money

"Nor shall [a ruler] acquire for himself excessive silver and gold." - Deuteronomy 17:17

Yesterday, the Texans for Fiscal Responsibility team, Andrew McVeigh, Vance Ginn, and myself, testified during the Texas Senate Finance Committee’s hearing of property taxes. I want to discuss some interesting points worth noting from the hearing.

Before I get to the hearing, let me point out one thing that underlies the discussions that took place yesterday: politicians cannot stop spending our money. Resistance to lowering property taxes comes from politicians who would rather spend our money on something else than giving it back to us.

As you can see in the above table, appropriations by 2023 Texas Legislature increased by $69 billion over what they did in 2021. Yet only $12.7 billion of that went to property tax relief. Texas’ political leaders were so desperate to spend our money last year—without us knowing what they were doing—that they busted the state’s constitutional spending limit by putting $13.8 billion of spending on the constitutional amendment ballot rather than taking the vote themselves to exceed the limit by $12.2 billion.

Generally, Texas politicians are not obeying Deuteronomy 17:17: "Nor shall [a ruler] acquire for himself excessive silver and gold." While $100 billion plus dollars of our money taken from us each year does not go directly into the pockets of our political leaders, by spending it to benefit their political constituencies in the Austin lobby, the corporate world, and state bureaucrats, our leaders are often able to stay longer in office and have access to income opportunities that are not available to most of us. I doubt most of them think of it in this way or do this intentionally, but it is what happens.

Back to the hearing. The first item of interest is that Texas Sen. Paul Bettencourt seemed very anxious to make sure that what Texas political leaders loudly proclaimed as “the largest property tax cut in Texas history” actually cut property taxes. He tangled with Ginn during the hearing when Ginn said otherwise.

Ginn used data from the Comptroller’s office that showed property taxes actually increased this year by about $165 million dollars despite the $12.7 billion the Texas Legislature devoted to property tax relief. One can see why Bettencourt—and other state and legislative leaders—might not like that public becoming aware of that news; it might be a threat to their job security.

As the Comptroller’s office admitted during the hearing, their data is incomplete. When the final data does become available, the one sure thing is that property taxes will have actually increased or decreased only slightly. The $12.7 billion of taxpayer money bought very little property tax relief for Texans, unless one agrees with the Legislature’s definition of it: “slowing the growth of taxes enough that politicians can claim they cut taxes and/or did something to make housing more affordable.”

Next, Bettencourt also took issue with something included in my written testimony: “Even last session’s $12.7 billion only reduced school property taxes by $4.1 billion.” Bettencourt, after my microphone had been turned off, claimed my statement was inaccurate because the $12.7 billion figure referred to the amount the Legislature dedicated to tax relief over the two-year fiscal biennium while the $4.1 billion referred to the reduction in school property taxes in one year. Bettencourt is half right here, but the main thing is his statement exposed how he and many other politicians had been doing the exact same thing he accused me off.

Before we get to that, we should note that Bettencourt and most other Texas politicians have been falsely claiming they provided $18 billion in tax relief, not $12.7 billion. Sen. Joan Huffman and Bettencourt tried to make the case for this at a March 15 Finance Committee hearing last year (starting at 22:09). Their point was is that if Texans really understood the complexity of the state budget they would see that the politicians in 2023 should get credit for paying for tax relief given to Texans back in 2019 and 2021. By that logic, they should also be getting credit for tax relief efforts dating back to 1997, long before either was in the Legislature—though they didn’t take it that far. The $18 billion was created using smoke and mirrors. Of perhaps we should use another metaphor: it was an attempt to pull the wool over taxpayers’ eyes. Either way, the number is $12.7 billion.

Getting back to my statement, it is true and does not misrepresent anything. Yes, the $12.7 billion is for a biennium. Yet, as I told Bettencourt in a friendly conversation after the hearing, he and others had been using the $12.7 billion the same way, not telling taxpayers that it would at most reduce their school property taxes by only $6.35 billion, not $12.7 billion—since property taxes are paid annually. The other $6.35 billion would simply pay for that initial reduction in the second year of the biennium, not bringing any addition reductions. Yet they never bothered to explain the biennial/annual difference until it became a threat rather than a benefit.

Here is the main point, though. The Texas Legislature spent $6.35 billion of our money this year to reduce our school property taxes. Yet school property taxes only dropped $4.1 billion, while property taxes overall remained essentially level. Why is that?

It is because the Texas Legislature did nothing last session, and has done little since property taxes became a political issue in 1997, to stop the massive tax increases imposes by schools and local governments on taxpayers to pay for their runaway spending. As a result, most our money spent on property tax relief was gobbled up by school districts and local governments. Yes, some homeowners did get tax cuts this year, and we should be appreciative. But in many cases their taxes will be higher next year than they were last year; in my case, my $900 tax cut this year will be gobbled up by an $1,100 increase next year. Meanwhile, taxes on businesses and apartments when up this year and will do so again next year.

Next, Sen. Charles Perry made the point that if folks come to them saying that property taxes should be cut, we should also come to them with ideas of where local governments could cut spending. Besides the fact that I and many other liberty-minded folks have been doing this for years, I mentioned to Perry (in another friendly post-hearing conversation) that the conversation of where spending can be restrained or cut to provide property tax relief or cuts should actually be taking place between local taxpayers and local politicians. We on the TFR team have provided recommendations that would make that happen: freezing school district property taxes and requiring local governments to ask voter permission to increase their property tax revenue by any amount. That way, if local politicians think they need more money from taxpayers they can make that case. If the politicians fail to persuade the taxpayers, then they can discuss what spending can be cut to ensure that priorities are taken care of.

Finally, many times at the hearing members brought up the fact that it would cost $81 billion to eliminate all property taxes and point to the problems of coming up with that amount of money and what would happen to local infrastructure projects if we didn’t fully replace the property tax funding.

In many ways, this is a strawman argument. The most popular proposals for property tax relief are to buy down school property taxes over about 10 years by restraining spending at the state and local level. Using this method, it doesn’t really cost anything to eliminate school taxes. We would use money that would have otherwise been spent elsewhere to buy down the taxes, while the tax burden is greatly reduced from what it would have been otherwise. But by focusing on the $81 billion needed to eliminate all property taxes at once, legislators can take attention away from the common sense, practical buy down solution funded by spending restraint—something which is anathema to most of them.

Unfortunately, the politicians are aided in this by some advocates who want to eliminate all property taxes at once by increasing other taxes. Some have called for increasing the sales tax to cover this. Discussion at the hearing yesterday suggested out sales tax rate might have to be 21% to cover this. Another group similarly calls for a consumption tax.

I believe it is a serious mistake for anyone to be taking this approach. First, because it provides politicians with political cover for not making serious efforts to provide property tax relief. Second, because eliminating all property taxes will almost certainly require the imposition of some other tax—swapping one tax for another is not tax relief. It will also create a huge, centralized bureaucracy and put the state of Texas in charge of all local finances; if you think Robin Hood property taxes and the state takeover of Texas local school districts has been a mess, you ought to be wary of this.

Instead, we should eliminate the school M&O property tax, freeze all property taxes, allow some limited increases only with voter permission, put strict limits on state and local spending growth, and remove the automatic loss of property for not paying taxes. Taken together, Texans property tax burden will be greatly reduced, the size and scope of government with be reduced, and Texans will once again own their property.

Read MoreGlenn Rogers and His Cronies

Glenn Rogers is running against Mike Olcott for Texas state representative. Olcott is supported by Donald Trump, Ted Cruz, Ken Paxton, and Sid Miller, but Roger’s campaign reports show that he is supported by political and corporate cronies, like Dade Phelan's $55,000 contribution and ...

Austin swamp Crony campaign donors to @RogersForTexas: Texans for Lawsuit Reform PAC $5000, Associated Republicans of Texas CF $5,963, @SpeakerStraus’ Texas Forever Forward PAC, $2,500, Linbarger Goggan … LLP $500, Texas Medical Association PAC $27,500 …

Read MoreDeWayne Burns and His Cronies

Rep. DeWayne Burns is running against Helen Kerwin in the Texas Republican Primary. Kerwin is supported by @realDonaldTrump, @KenPaxtonTX, @GregAbbott_TX, & @DanPatrick. Burns’ campaign reports show he is supported by political and corporate cronies, such as: @DadePhelan Campaign $35,000. And ...

Austin swamp Crony campaign contributors of @Burnsfarms: @DadePhelan Campaign $14,600 (in-kind), Texans for Lawsuit Reform PAC $39,600, @TXGOPCaucus PAC $1000, Associated Republicans of Texas Campaign Fund $11,680 (in-kind), Wholesale Beer Distributors of Texas PAC $2000, and

Read MoreRecommendations on 2024 Texas Republican Primary Ballot Propositions

Here are my recommendations on the 2024 Texas Republican Primary Ballot Propositions

1.) Texas should eliminate all property taxes without increasing Texans’ overall tax burden. No. The language here is fraught with loopholes and would not result in lower taxes. It should read, “Texas should reduce our tax burden by eliminating all property taxes using budget surpluses without increasing any existing taxes or creating new ones.

2.) Texas should create a Border Protection Unit, and deploy additional state law enforcement and military forces, to seal the border, to use physical force to prevent illegal entry and trafficking, and to deport illegal aliens to Mexico or to their nations of origin. Yes.

Read MoreJustin Holland and His Cronies

TxLege state Rep. @justinaholland claims he is a “proven conservative.” But his two most recent campaign finance reports suggest that instead he is a proven political and corporate crony. Let’s take a look. …

From July 1 thru Jan. 25, @justinaholland received campaign contributions totaling $507,183. His total political expenditures were $607,628. That is a lot of money. In the next several tweets, we will take a look at where all his campaign money came from. …

@justinaholland Political crony donors: Dade Phelan Campaign, $50,000+$15,475 (in-kind); TLR PAC, $40,000; ART Campaign Fund, $21,517 (in-kind); HillCo PAC, $26,500; K&L Gates Committee for Good Government, $1,000; Linebarger Goggan Blair & Sampson LLP, $1,000 …

Read MoreUAW Strike is a Result of the Biden Administration’s Catering to Unions

This was originally published in the Dallas Morning News

The United Auto Workers strikes of General Motors, Stellantis, and Ford may bring back unpleasant memories of the 1970s. A similar strike then — and subsequent concessions from the car manufacturers — helped set the stage for the collapse of the American auto industry and economy.

Hampered by high costs and inflexible work rules, the automakers were ill-prepared to meet the onslaught of international competition they faced when Toyota and Honda delivered less expensive cars that were more reliable and achieved better gas mileage.

Perhaps the UAW has not noticed, but their employers still face keen competition, with cars from Japan, South Korea, Germany and other countries flooding the U.S. market. The incipient threats today are Tesla and the other startup manufacturers of EVs, which use nonunion labor and operate factories that are much more mechanized than the production line for a gas-operated car.

However, the boldness of the UAW’s demands may stem not from ignorance but from the Biden administration’s undermining years of economic and regulatory progress that reduced unions’ stranglehold over certain sectors of the U.S. economy. Given that the strike has expanded into parts centers in Roanoke, Carrollton and this week in Arlington’s GM plant, this should be of concern to Texans who are worried about the state’s and nation’s economic health.

Read MoreConstitutional Amendments: Voters Can Downsize Texas Government on November 7

(download a .pdf version of the article)

The Texas Legislature has put $13.8 billion in spending on the November 7 constitutional amendments ballot. A vote by Texans to reject eight of these propositions (see below) would cut Texas’ spending of state funds by $13.8 billion, or more than 6% of projected spending over the next two years. This gives Texans an unprecedented opportunity to reduce the size and scope of Texas government.

Normally, politicians—who love to spend our money—would never give us this opportunity. But Texas politicians had a choice to make this spring. With a record $80 billion of new revenue available, they could either spend the money or give it back to Texas taxpayers in the form of property tax relief. Unfortunately for Texans, for the most part they chose to spend the money.

Constitutional Amendments: Big Business Wants Billions of Taxpayer Dollars

(download a .pdf version of the article)

On November 7, Texas voters are being asked to approve $13.8 billion in new spending over the next two years proposed by the Texas Legislature. As noted elsewhere, this is because the Texas Legislature wanted to spend more money than allowed by the Texas Constitution. So instead of taking a dangerous political vote themselves to “bust” the state spending cap, Texas politicians decided to pass the buck to voters.

The new spending, which is covered by eight propositions on the ballot (see below), is for things like infrastructure, teacher retirement, and parks. While there might be some debate about the merits of these propositions, the primary beneficiaries of the $13.8 billion is seen in the sponsors of the political advertising in support of the spending.

For instance, above are the members of the Texas Infrastructure Coalition, sponsored by the Texans for Opportunity and Prosperity PAC, that are advocating in support of propositions 6, 7, and 8, which would spend $7.5 billion if approved by voters. However much Texans might benefit from the spending, these businesses—and the Texas politicians that have proposed it—would benefit more.

Here is a list of the amendments that would increase state spending by $13.8 billion and benefit special interests and corporations:

Read MoreA Review of the 88th Texas Legislature: the Texas Budget

The Texas Legislature adjourned May 29 ending its 88th regular legislative session. In its wake, a lot of bills were sent to Texas Governor Greg Abbott to become law with his signature. Many more bills were not passed or even considered. In this review of the Texas Legislature, we will review the bills that passed and make up the Texas Budget.

The Texas Legislature began its session this year with approximately $70 billion in new funds to spend over what they spent in 2021, including a record $32 billion surplus left over from 2023. Unfortunately, the Legislature decided to spend almost all of the money it could get its hands on.

"Public-Private" Partnerships are Corrupt

God's Word provides us with more knowledge than any of us could learn in a lifetime. I'm fact, I'd suggest it provides us with more knowledge than all of humanity could learn throughout eternity. But that doesn't mean we shouldn't keep mining it for everything we can learn from it. Thus, I'd suggest it would be worth our while these days to dig into Scripture to develop a theology of the Censorship-Industrial Complex (see below for the article by Margot Cleveland at the Federalist). Christians should be leading the way in developing ideas about to deal with this clear and present danger.

Of course, the partnership of government with industry is nothing new; neither it its threat to liberty. President Dwight Eisenhower warned us about the Military-Industrial Complex in the 1950s; we did not listen very well. The Budgetary-Financial Complex, the partnership between congressional appropriators and Wall Street, has been in place since Congress created the Federal Reserve in 1913. And the Regulatory-Rent Seeking Complex, the partnership between regulators and businesses seeking profits through government rather than markets, has been alive and well since the passage of the Sherman Anti-Trust Act was passed in 1890.

Yet Americans--and American Christians--have just sat around watching these partnerships continue as if God has no problem with corruption. Margot Cleveland does a great job of describing the problem of the "public-private" partnerships in her article:

How Trump Derangement Gave Birth to the Censorship-Industrial Complex

by Margot Cleveland

The Biden administration may have abandoned plans to create a “Disinformation Board,” but a more insidious “Censorship Complex” already exists and is growing at an alarming speed.

This Censorship Complex is bigger than banned Twitter accounts or Democrats’ propensity for groupthink. Its funding and collaboration implicate the government, academia, tech giants, nonprofits, politicians, social media, and the legacy press. Under the guise of combatting so-called misinformation, disinformation, and mal-information, these groups seek to silence speech that threatens the far-left’s ability to control the conversation — and thus the country and the world.

Americans grasped a thread of this reality with the release of the “Twitter Files” and the Washington Examiner’s reporting on the Global Disinformation Index, which revealed the coordinated censorship of speech by government officials, nonprofits, and the media. Yet Americans have no idea of the breadth and depth of the “Censorship Complex” — and how much it threatens the fabric of this country.

In his farewell address in 1961, President Dwight D. Eisenhower cautioned against the “potential for the disastrous rise of misplaced power” via the new sweeping military-industrial complex. Its “total influence — economic, political, even spiritual — [was] felt in every city, every statehouse, every office of the federal government.” Replace “military-industrial” with “censorship,” and you arrive at the reality Americans face today.

Origins of the Censorship Complex

Even with the rise of independent news outlets, until about 2016 the left-leaning corporate media controlled the flow of information. Then Donald Trump entered the political arena and used social media to speak directly to Americans. Despite the Russia hoax and the media’s all-out assault, Trump won, proving the strategic use of social media could prevail against a unified corporate press. The left was terrified.

Of course, Democrats and the media couldn’t admit their previous control over information converted to electoral victories and that for their own self-preservation, they needed to suppress other voices. So instead, the left began pushing the narrative that “disinformation” — including Russian disinformation — from alternative news outlets and social media companies handed Trump the election.

The New York Times first pushed the “disinformation” narrative using the “fake news” moniker after the 2016 election. “The proliferation of fake and hyperpartisan news that has flooded into Americans’ laptops and living rooms has prompted a national soul-searching, with liberals across the country asking how a nation of millions could be marching to such a suspect drumbeat. Fake news, and the proliferation of raw opinion that passes for news, is creating confusion,” the Times wrote, bemoaning the public’s reliance on Facebook.

Read the rest at the Federalist.

Read MoreProperty Taxes Up 12% in 2022 Despite Legislature's Promise of Tax Relief

This was originally published by the Huffines Liberty Foundation.

Executive Summary

The office of Texas Comptroller Glenn Hegar reports that school property taxes in 2022 increased 13.7% over the previous year. City taxes were also up 9.1%, county taxes 12.7%, and special district taxes 9.4%. This adds up to a $8.9 billion property tax increase in the same year that the Texas Legislature’s 2021 property tax “relief” effort took effect.

The 12.17% property tax increase is hard to under-stand given the limits the Texas Legislature put on property tax revenue growth in 2019. For instance, county and city property tax revenue growth is limited to only 3.5% above the “no-new-revenue” rate without voter approval. It turns out, however, that the Legislature’s limits on property tax growth leak like a sieve and allow property taxes to grow much faster than anticipated.

With the Texas Legislature sitting on an unprecedented $64 billion in new revenue, it is possible to provide real and lasting property tax relief for Texans by eliminating the school maintenance and operations (M&O) property tax in as few as 4 years. But in order to do this, the Legislature must use all of the current $32 billion surplus to provide property tax relief and change the current dysfunctional property tax system by taking these steps: 1) limit state spending growth to no more than 5% per biennium; 2) freeze school M&O property taxes; 3) use 90% of future Texas budget surpluses to buy-down M&O property taxes; and 4) require voter approval for local governments and special districts to exceed the no-new-revenue tax rate.

Introduction

One of the problems with unlimited government is how its complexity masks the truth from voters and taxpayers. One example of this is Texas property taxes. Tex-as politicians for years have been bragging about what a great job they have done providing property tax relief for Texans. For instance, at a press conference on property tax relief and school finance in May 2019, Lt. Gov. Dan Patrick declared, “We have had the Super Bowl of legislative sessions in the history of this state, and I think in the history of this country” (The Texan). More recently, Patrick noted that 2022 “was the first time [property owners] saw the benefit of what we did in 2019.”

However, these claims have been called into ques-tion by data recently released by the office of Texas Comptroller Glenn Hegar. According to the Comp-troller’s office, since the Texas Legislature’s Super Bowl session of 2019, the Texas property tax levy from schools, counties, cities, and special districts has increased by $15.4 billion, an average annual increase of 6.3%. More than half of that increase came in the last year, despite the Texas Legislature’s additional property tax relief efforts in 2021.

In fact, the $8.9 billion, 12.2% increase of all property taxes from 2021-22 is difficult to explain even for analysts and agency employees who have been working on these issues for years. As is the $5.3 billion, 13.7% increase in school property taxes. The problem stems from attempting to explain how recent attempts by the Legislature to slow the growth of property taxes failed so spectacularly. If the Comptroller’s data is accurate, however, an explanation is needed, particularly since Texas politicians are trying to determine how much of the $64 billion of new revenue the Texas Legislature has on hand will be used for their third attempt at property tax relief in the last five years.

The Texas Comptroller’s Data

Figure 2 shows the growth in Texas local government property tax revenue since 2018. The data comes from the Texas Comptroller, though the special district and county figures for 2022 have been adjusted to account for some missing data.

The Comptroller shows a rapid growth of property tax revenue since 2018. The 6.77% average growth in revenue during that period is higher than the average 6.1% growth rate since 1996, despite the Legislature’s attempts in 2019 and 2021 to provide relief.

There were two approaches to relief during this period. First, in 2019 and 2021, the Texas Legislature spent an extra $3.1 billion annually to “buy down” or compress rates for the school district M&O property tax. Second, the Texas Legislature put limits on the revenue growth from all districts that could only be exceeded through voter approval. These “voter approval” growth limits were 3.5% for counties and cities, 8% for special purpose districts, and approximately 5% for school districts. These limits raise the question that is being asked in light of the Comptroller’s numbers for 2022 revenue growth; how can the property tax levy increase at a rate so much higher than the limits set in state law? The answer, it seems, is that the limits on revenue growth are largely smoke and mirrors designed to make Texas voters believe that Texas politicians are doing something to control runaway property taxes when they are not.

The Leaky, Loophole Ridden Limits on Property Tax Revenue Growth

The current general restriction on the growth of property tax revenue is known as the “voter-approval tax rate.” As the title indicates, a tax entity cannot set a property tax rate higher than the voter-approval tax rate without approval of a majority of voters in an election.

For counties and cities, the maintenance and operations voter approval tax rate is the no-new-revenue maintenance and operations rate x 1.035. For special districts, it is the no-new-revenue maintenance and operations rate x 1.08. And for school districts it is the “rate per $100 of taxable value that is equal to the district’s maximum compressed rate times $1.00 plus the greater of: the previous year’s enrichment rate or $0.05 per $100 of taxable value” (Texas Comptroller).

Though the language is confusing, the average voter might believe that the limits on the growth of property taxes, without voter approval, range between 3.5% (counties and cities) and 8% (special districts). But that would be incorrect. There are so many exceptions and loopholes to the growth limits above that it is virtually impossible to calculate what the limits actually are. Apparently, though, based on the Comptroller’s numbers, the limits can be stretched to allow school taxes to increase by at least 13% annually and all property taxes by at least 12%.

The following are some examples of the loopholes to the limits on property tax growth. They are not exhaustive, but they do offer some insight into the fact that the Texas Legislature has made property tax limits so complex and confusing that most Texans cannot understand them:

No-New-Revenue Tax Rate: This rate does not actually result in no new revenue for a district. Instead, it provides for no new revenue from properties that are in the same condition in the new year as they were in the previous year. But taxing entities can still increase property tax revenue from “new development.” For instance, Harris County adopted a no-new-revenue tax rate this year. Yet the rate provided Harris County with $66 million in new revenue this year, an increase of 3.3% (8, Huffines Liberty Foundation).

Unused Increment Rate: This rate allows districts to “bank” unused increases from the previous two years. As an example, since Harris County used none of its voter approval 3.5%increase for 2022, the county could raise it taxes by 7% over the now-new-revenue rate in 2023 without voter approval. If the county experiences growth this year similar to last year, property taxes in Harris County could jump by more than 10% in 2023 without the voters having any input.

Debt Rate: The 3.5% limit in voter-approval tax rate does not include growth in property taxes used to pay debt. For the most part, debt must be approved by voters in a bond election. But often deception is involved in these elections as well. Last year, Ft. Bend I.S.D. asked voters to approve a property tax increase of 7.5% above the no new revenue rate. In trying to gain ap-proval for the increase, the district told voters that the new tax rate would be the same as the previous year’s without mentioning that the district’s revenue will increase by $47.66 million and homeowner’s tax bills will increase 7%(4, Huffines B) because of growth in property values.

Tax Rate Compression: In 2019, the Texas Legis-lature passed HB 3, which, among other things, forced districts to compress their M&O tax rates by an amount depending on the district’s prop-erty value growth above 2.5%. However, the complexities of the compression requirements, differing tax rates, and widely ranging growth in property tax values across districts have allowed districts to increase revenue far above the 2.5% generally portrayed as the limit.

Conclusion

The Texas Legislature currently has the largest bud-get surplus in state history at about $32 billion. Add to that projected revenue for the next two years, Texas politicians are sitting on about $64 billion of new revenue. Yet they have said they would use only about $10 billion for property tax relief this session. Unless the Legislature at least triples the amount of property tax relief and makes significant changes to put school M&O on the path to elimination, the results this year will mirror what we have seen before; more spending on education with only minor and temporary property tax relief.

It is possible, though, to bring permanent property tax relief for Texans by eliminating the school M&O property tax. Here is how:

Limit State Spending Growth

Limiting state spending growth to no more than 5% per biennium (~2.47% annually) will provide adequate state revenue to eliminate the M&O portion of school property taxes within 10 years.

Freeze School M&O Property Taxes

Eliminating the ability of school districts to in-crease M&O property taxes by freezing school property taxes at the current level stops school districts from interfering with a buydown.

Use 90% of Current and Future Texas’ Budget Surpluses for the Property Tax Buydown

Fiscal discipline at the state level will provide enough funds to eliminate the M&O property tax in 10 years (or less) only if 90% of the surpluses generated are used for the buydown.

Require Voter Approval for Local Governments to Exceed the

No-New-Revenue Tax Rate

Cities and counties constantly undermine proper-ty tax relief by rapidly filling in the gap created by reduction in school property taxes. They should be required to ask voters for permission if they want to keep doing so.

Read MoreHow to Eliminate Texas School Property Taxes in 10 Years (or Less)

Texas’ school M&O property tax, about 43% of the current $76.4 total property tax levy, can be eliminated in as little as six years without raising any existing taxes or creating a new tax.

Yet, for 25 years Texas politicians have been unsuccessful in their attempts to reduce the heavy burden of property taxes on Texans. Five major reform efforts took place in 1997, 2006, 2015, 2019, and 2021. All of these efforts have three things in common.

First, they failed. Only the 2006 attempt resulted in even a minor reduction in the property tax burden—and that was temporary. In all cases, the efforts failed to stop the rapid increase in property taxes. In 1996, the total property tax levy in Texas was $16.8 billion. In 2021, it was $73.5 billion.

Read MoreThe Problem with Big Government

I recently spoke to the Brazos Valley Republican Club about the problem with Big Government. We focused on the problems with Texas' budget, property taxes, and electric grid.

While there are a lot of problems in Texas that Christians and conservatives need to deal with, such as election integrity, Democrat chairs in the Texas House, further protecting unborn babies, the sexualization and mutilation of Texas kids, the invasion of Texas' border, parental rights in education, and gun ownership, I'd suggest the primary issue we need to deal with is shrinking big government. As I told the great group of folks in College Station, we can’t stop Big Government from taking away our God-given unalienable rights. Our only successful path to Liberty is to turn Big Government into Little Government.

You can download my PowerPoint presentation here.

Read MoreBig Government Isn’t the Solution to Big Tech Censorship

It is no secret that Big Tech and conservatives aren’t close friends these days. Responding to this concern, Republican House members last year assembled a Big Tech Censorship and Data Task Force to hold Big Tech accountable for anti-conservative bias and censorship.

Now, however, Republicans in Congress are taking things too far by partnering with Democrats to deal with the Big Tech censorship issue with a barrage of antitrust legislation.

Of particular concern is Republican support for “The American Innovation and Choice Online Act,” which would give unprecedented authority to bureaucrats at the Federal Trade Commission and Department of Justice, allowing them to decide what is lawful, who those laws apply to, and what the penalty for breaking the law will be.

Read MoreTexans Property Taxes are High Because Texas Politicians Like it That Way

States compete using various means to attract new businesses and residents to drive economic growth. For instance, CNBC ranks America’s Top States for Business with criteria such as Cost of Doing Business, Infrastructure, Business Friendliness, and Technology and Innovation. It also includes criteria that are more focused on residents, including Life, Health, and Inclusion and Cost of Living. Getting under the hood on these categories, it seems as if the primary factor in CNBC’s rankings is a state’s willingness to spend taxpayer money to the benefit of business.

The Rich States, Poor States ranking by the American Legislative Exchange Council takes a different approach. Its ranking criteria include Top Marginal Income Tax Rates, Property Tax Burden, Public Employees Per 10,000 of Population, Right-to-Work State?, and Tax Expenditure Limits. While both rankings take into account costs on businesses, Rich States, Poor States places greater value in factors that move a state toward “life, liberty, and the pursuit of happiness,” such as lower government spending, less regulation, and economic liberty.

In his book, The Tyranny of Experts, Dr. William Easterly explains there are two different approaches to economic development. One is authoritarian development, a technocracy in which “well-intentioned autocrats advised by technical experts” focus on technical solutions to economic development while ignoring the “rights of real people” (p. 5). The second approach he calls “free development,” which gives free individuals with political and economic rights “the right to choose amongst a myriad of spontaneous problem-solvers, rewarding those that solve our problems”

An examination of Texas from these two perspectives yields the conclusion that Texas is double-minded. On the one hand, Texas ranks 47th in state spending per capita, does not have a personal income tax, and has relative strong property rights protections. On the other hand, Texas’ spending jumps to 36th when local government spending is accounted for. It also has numerous taxpayer-funded giveaways to attract businesses, including the Texas Enterprise Fund and local property tax abatements such as Chapter 313 for school districts and Chapter 312 for local governments. Texas’ economic development policy appears to be unstable, “like a wave of the sea that is driven and tossed by the wind.

A prime example of Texas’ partial embrace of authoritarian economic development policies is Texas’ elected officials support of high property tax rates for most Texans while offering tax abatements to politically connected businesses. This approach allows Texas’ schools and local governments to keep spending at relatively high levels while using the tax abatements to keep the state “business friendly” enough to keep the economy growing--and business off the backs of the politicians. Figure 1 shows how Texas property taxes have skyrocketed since 1996, the year before the Texas Legislature began a long string of failed attempts to relieve Texas' property tax burden. Figure 2, which compares Texas property tax rates to other states, confirms the heavy property tax burden imposed on Texans because of Texas’ approach to economic development.

The reason that Texans have high property taxes is very simple: Texas' statewide elected politicians and members of the Texas Legislature politicians prefer high property taxes to low property taxes. Because if they actually got serious about reducing property taxes, they'd have to restrain spending by local governments. And they have decided it is better, since they have bought off big business with tax abatements, to deal with complaints by Texas voters over high property taxes than it would be to deal with complaints from city councils, county commissioners' courts, and school boards upset about not being able to build more bike paths, homeless shelters, and football stadiums. After all, why should Austin politicians worry about voters when big business and local governments are going all out to keep their benefactors in office? Texas' voters only hope of getting politicians to do anything meaningful to reduce or eliminate property taxes is make them start worrying about us.

Read MoreTexas Politicians and Citizens Enable Corporate Theft

It was not that long ago that property tax abatements were illegal in Texas because they were

considered to be theft.

The market’s job was to create jobs and grow the economy. The government’s job was to

ensure a level playing field for all market participants through efficient civil and criminal justice

systems and limited regulation.

Acknowledging the ethical and economic problems with the government giving taxpayer money

to individuals or businesses, the Texas Constitution contained what is known as the Gift Clause,

which prohibited the “grant[ing of] public money or thing of value in aid of, or to any individual,

association or corporation.”

Then in 1987, the Legislature sent a constitutional amendment to Texans allowing the “creation

of programs and the making of loans and grants of public money … for the public purposes of

development and diversification of the economy of the state, the elimination of unemployment

or underemployment in the state.” It passed by the narrow margin of 51.7 percent of the

popular vote.

Protestant Resistance Theory

Romans 13 tells us to "be subject to the governing authorities."

Yet the leaders of the Protestant Reformation, from Luther and Calvin to Knox, Rutherford, Junius Brutus, and others, had a problem: the rulers they were supposed to be subject to were trying to, or actually did, murder them. To understand what the Bible taught about this, they spent the better part of 200 years studying and writing about it.

The result is today the body of work we call Protestant Resistance Theory. By far the best and most accessible modern book I've read on this is Slaying Leviathan by Glenn Sunshine.

Read MoreRule by Experts: Two Approaches to Economic Development

“The conventional approach to economic development … is based on a technocratic illusion: the belief that poverty is a purely technical problem amendable to … technical solutions.” ~ William Easterly

Under significant political pressure from the left and the right, the Texas Legislature last year let expire the Chapter 313 "economic development" program that allows Texas school districts to offer property tax abatements to politically connected businesses. Now, big business interests are joining with many of those politicians to bring the program back to life, despite evidence of the great harm it has caused.

According to Dr. William Easterly, programs like Chapter 313 are economically and ethically flawed. In his book, The Tyranny of Experts, he explains there are two different approaches to economic development. One is authoritarian development, a technocracy in which “well-intentioned autocrats advised by technical experts” focus on technical solutions to economic development while ignoring the “rights of real people” (p. 5). The second approach he calls “free development,” which gives free individuals with political and economic rights “the right to choose amongst a myriad of spontaneous problem-solvers, rewarding those that solve our problems” (p. 6). Here, I'll refer to them as technocratic development and free-market development.

Read MoreBig Business Pushes for More Tax Breaks at Taxpayer Expense

Last Thursday I spent 11 hours at the Texas state Capitol in Austin. The occasion for all the fun was a hearing by the House Ways and Means committee on issues related to property taxes.

It was pretty amazing to watch the proceedings. One of the biggest problems we have in America today is that our various governments take far more of our money than they are entitled to and then spend it on things they do not have authority to spend it on or give it to people they do not have authority to give it to. This is certainly the case when it comes to property taxes in Texas.

Yet throughout the day, most of the discussion from both House members and those who testified was focused on how to make Texas' property tax system more efficient or to use it to give big tax breaks to big business. Nobody on the committee seemed concerned that property taxes in Texas are driving people out of their homes, being spent to groom our children to ignore God and instead live a life serving Marxist and gay ideologies, and being used to attract renewable energy generators who are wrecking our electric grid.

Read MoreReplacing Big Tech with Big Government Won’t Benefit Consumers

This commentary originally appeared in the Dallas Morning News.

In his farewell address delivered just over 60 years ago, President Dwight Eisenhower warned Americans to “guard against the acquisition of unwarranted influence, whether sought or unsought, by the military-industrial complex. The potential for the disastrous rise of misplaced power exists and will persist.”

Critics of the high-tech industry consider companies such as Amazon, Google and Apple to have misused market power and harmed competition. It certainly is true that those firms have a significant advantage because they effectively own and operate online marketplaces that have come to be used by hundreds of millions of shoppers. Third-party online retailers or app developers that use these platforms have the challenge that, in addition to competing against each other, they also have to compete against Google, Apple and Amazon.

Read MoreOpportunity to Tell the Texas Legislature to Abolish Chapter 313

It was not that long ago that property tax abatements were illegal in Texas because they were considered to be theft.

This historic and biblical perspective was embedded in the Texas Constitution. Acknowledging the ethical and economic problems with the government giving taxpayer money to individuals or businesses, the Constitution contains what is known as the Gift Clause, which at one time prohibited the “grant[ing of] public money or thing of value in aid of, or to any individual, association or corporation.” This provision helped Texas avoid the corruption inherent with private citizens getting rich at the expense of taxpayers and reduced the transfer of wealth from productive Texans to those who were less productive but more politically connected.

Read MoreChapter 312 and 313 Tax Abatements are Theft

Property tax abatements under Chapters 312 and 313 of the Texas Tax Code allow counties, cities, school districts, and special purpose districts to reduce the amount of taxes paid by favored businesses that locate or expand within their geographic boundaries. They are used by renewable energy developers in concert with state and federal subsidies to turn a profit on what would otherwise be an unprofitable investment in highly inefficient renewable energy.

Exemptions from Texas’ Open Meetings and Public Information Acts means that negotiations between the taxing entities and private businesses usually take place behind closed doors.

These exemptions mean that most public input into the process will take place after the governing bodies have negotiated with the business seeking the abatement for months and essentially decided to move forward with the abatement.

Read MoreTwo Approaches to Economic Development

“The conventional approach to economic development … is based on a technocratic illusion: the belief that poverty is a purely technical problem amendable to … technical solutions.” ~William Easterly, The Tyranny of Experts