New Spending Reduces Potential Tax Cuts Now and in the Future

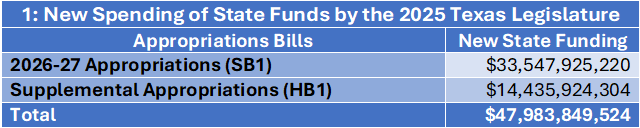

When the Texas Senate meets this week to adopt the 2026-27 budget for the state of Texas, it is likely to put Texas on track to approve almost $48 billion in new spending of state funds. Out of the $48 billion in new spending, only $6 billion is set aside for property tax relief.

Figure 1 breaks down the new spending. Senate Bill 1 is the Legislature’s appropriations bill for the upcoming 2026-27 fiscal biennium. It contains $33.5 billion in new spending. House Bill 500 is the Legislature’s supplemental appropriations bill for spending during the current 2024-25 fiscal year. It may lead to $14.4 billion in new spending.

New spending does not always correlate precisely with increased biennial spending. The importance of determining new spending in the budget is that it allows us to calculate how much tax relief Texan taxpayers could get if the Legislature prioritized reducing our taxes over new spending that benefits other legislative constituents, who often use our tax dollars to hire lobbyists so they can get a bigger cut of the pie next time around.

New Spending in Senate Bill 1 (Appropriations for 2026-27)

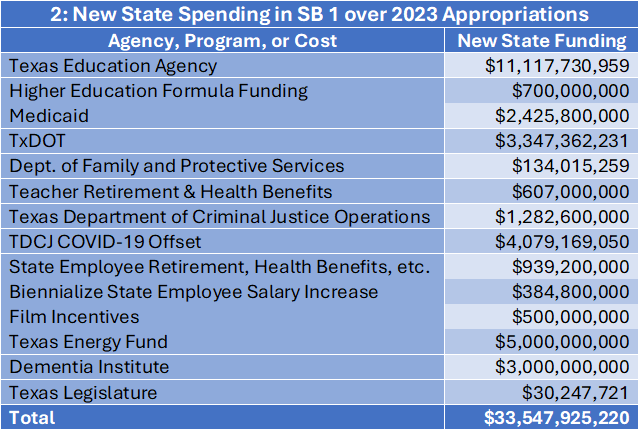

The Texas Legislature goes to great lengths to hide new spending from Texans. The budget reports created by the state’s Legislative Budget Board are accurate, but new spending is hidden through the aggregation of spending numbers, shifting spending between state and federal funds, and using improper baselines for measuring increases in spending.

For instance, the summary of Senate Bill 1 shows that in Article III total education spending of state funds will increase by $7.4 billion in 2026-27. Yet contained in the education spending is $11.8 billion in new spending of state funds.

Another example is Article V which shows that total spending—including federal funds—on public safety and criminal justice will increase by only $1.2 billion in 2026-27. Yet the spending of state funds in 2026-27 will increase by $6.6 billion as the Legislature has to fill in with Texan’s tax dollars a budget hole created by the end of federal COVID-19 funding the state used during the last biennium.

Figure 2 shows some of the new spending in the committee substitute to Senate Bill 1 (CSSB 1). The new spending includes $500 million of film industry subsidies to “Establish[] Texas as America’s Film Capital,” $5 billion to subsidize natural gas generators in an attempt to compensate for billions of subsidies for wind and solar generators, $1.3 billion to pay for increased state employee pay and benefits, and $30 million to increase funding for the Texas Legislature.

New Spending in House Bill 500 (Supplemental Appropriations)

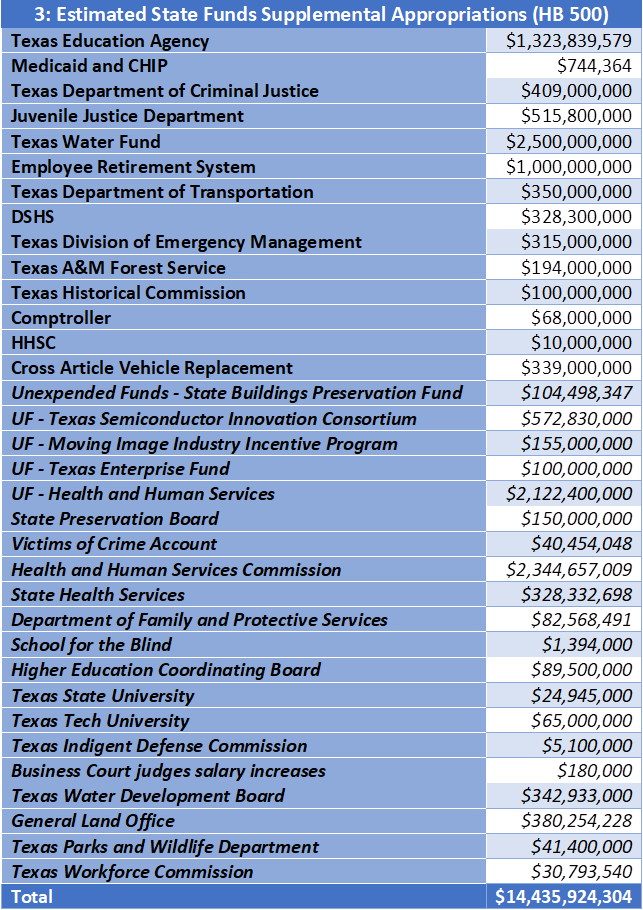

The supplemental appropriation bill is traditionally used to correct errors in 2023 projections for how much funding is needed in the current 2024-25 biennium. It is still used for that. However, House Bill 500 is also used to distribute some of the budget surplus to agencies and other legislative constituents in a way that lessens the scrutiny on new spending. One way this works is that new funding is put into the budget for the current biennium in order to increase the baseline for spending increases for next biennium. This allows the Legislature to increase spending by sneaking around the Texas Constitution’s tax spending limit.

Figure 3 shows the estimated spending of state funds in House Bill 500. The first, non-italicized spending items are from the Senate’s recommended supplemental spending. The italicized entries come for the introduced version on HB 500. Thus, the amounts in Figure 3 are early estimates based on figures published by both legislative bodies.

Conclusion

Texans will never see real tax cuts or smaller, less oppressive government unless the Texas Legislature stops spending more money. The $48 billion in new spending this session pushes the possibility of lower taxes and smaller government farther into the future.

Discover more from

Subscribe to get the latest posts sent to your email.